Every hospitalization insurance policy comes with a designated waiting period which specifies the number of days that must elapse before the policy coverage begins for specific health conditions. The waiting period differs according to the insurance companies. Before you opt for any health insurance policy for a family, you should first thoroughly understand the waiting period concept as different coverage has different waiting periods and different rules. There have been reported many cases where customers subscribe to insurance policies offering incorrect details. To avoid the losses caused by wrongful claims or misrepresented medical history, the insurance companies introduced the concept of a waiting period.

To commence with, the waiting period is a specific span of time before a select list of ailments starts getting covered under your intended health policy.

Types of waiting period:

- The first is the initial waiting period, which means that if a person gets hospitalized in the first 30 days after starting the policy, they won’t receive any claim benefit from the insurance. After the waiting period has been completed, the policy would cover the specified health conditions; otherwise, no claim will be entertained by the insurance company. You should also note that this 30 days waiting period is for illnesses but not applicable for injuries.

- The second waiting period is the pre-existing waiting period. This waiting period is relevant only for the specific health conditions that the policyholder has disclosed at the time of subscribing to the policy. This waiting period is a type of waiting period that involves a condition of one to four years before signing up for health insurance. The length of this waiting period can, however, differ from 12-48 months. Thus, the pre-existing waiting period will be covered under the plan over the time frame mentioned in the insurance policy.

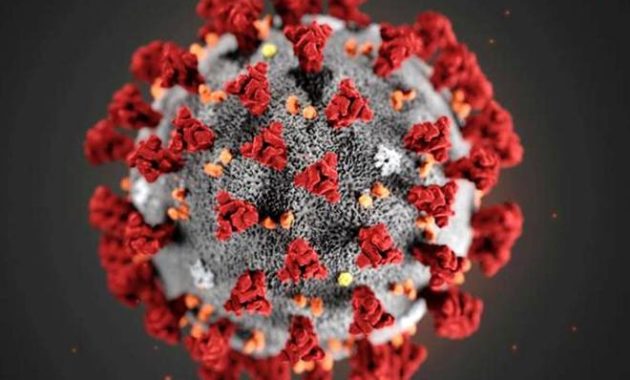

- While taking a policy, you should check for the waiting period of specific diseases listed in your health policy. There is a lump-sum amount paid in the critical illness policy if the ailment is covered under your policy’s critical illness section. However, COVID-19 is not covered under critical illness, except for specifically designed products introduced in the market recently.

There are various questions raised for illnesses like H1N1, Ebola, and the latest one being Coronavirus are included in the health insurance and whether or not they have the waiting period associated with it. However, many health insurance policy providers mentioned that COVID-19 could be covered in the health insurance policy, ensuring that your saving is not being affected by it. It is highly advisable to check with your insurer about the terms, conditions, and exclusions.

Health crisis may come to anyone at any point in time, so it is wise to take up health insurance plans to keep yourself and your family financially secure. Several insurance companies offer different critical illness plans with different hospitalization. So before you choose health insurance plans health insurance for your family, you need to research thoroughly to make an informed decision.